Arbitrum, Ethereum’s scaling solution, has dominated the Layer-2 landscape since the beginning of 2023. The emergence consequently empowers the projects built on the chain. In this article, we’ll look at the best projects on Arbitrum and the unique points that make them stand out.

Why Arbitrum?

The market setback has turned a number of crypto investors into a hunt for new promising land. Amid the uncertainty, the opportunity represented by Arbitrum has stirred up intense interest across the DeFi communities.

When Offchain Labs activated Arbitrum in 2021, the team aimed to exceed Ethereum’s specific limits – hefty fees and congestion. The debut held great promises. And when brand promises successfully fulfill expectations, success follows.

Today, Arbitrum has the highest Total Value Locked (TVL), surpassing $3.4B. The initial success is an enjoyable milestone not only for the Layer-2 network but also for several projects built on it. We’ve rounded up the five most promising projects on Arbitrum, how they work, and some key features to look for.

Please note that this is for informational purposes only.

5 Best Projects On Arbitrum

-

GMX (GMX)

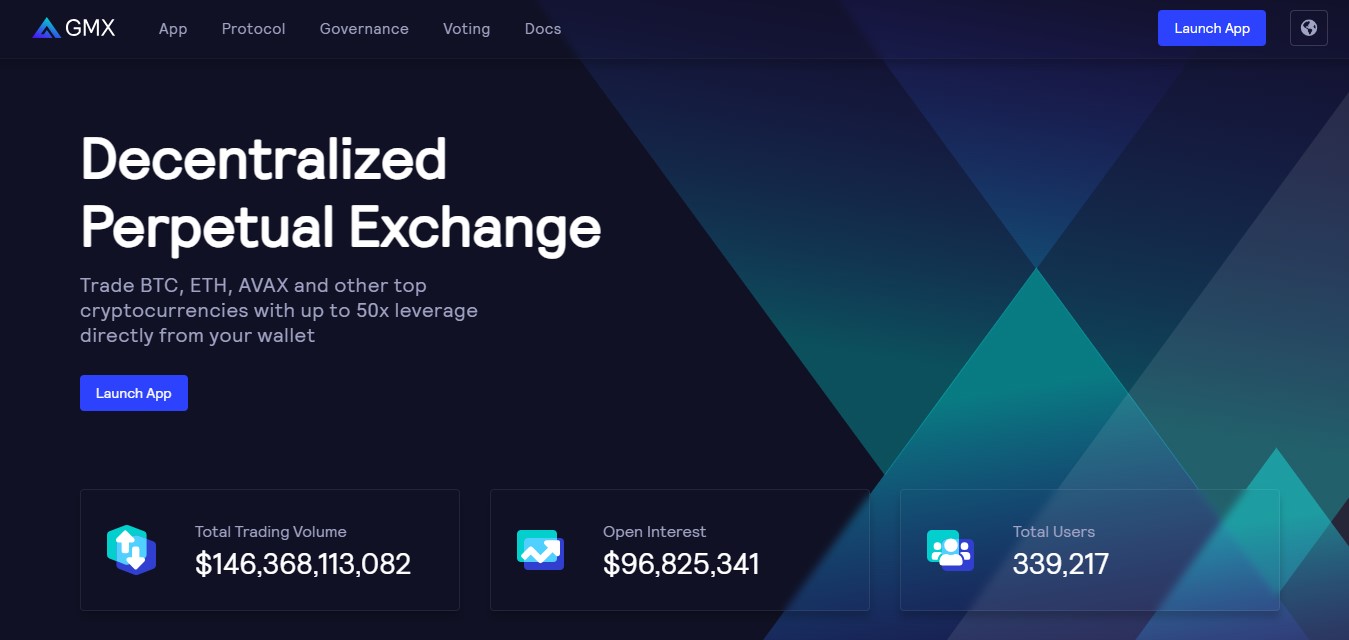

GMX (GMX) is a decentralized crypto exchange that focuses on spot trading and perpetual trading products. The team behind GMX is fully anonymous, with the only known information being that they previously worked on two other protocols, XVIX and Gambit. These earlier projects were eventually merged to create GMX.

Unlike centralized exchanges, trading on GMX is accessible to all users with a supported wallet. Users participate in GMX directly with their wallets and there is no need for a username or password setup.

It’s no doubt that GMX is positioned as one of the most promising projects on Arbitrum. The platform comes with an ease of use and wallet connection. It also stands out with its low trading fees and up to 50x leverage trading. Plus, its incentive program provides users with different ways to earn rewards.

GMX is currently live on Avalanche and Arbitrum. The exchange supports the trading of several major coins and tokens, such as Bitcoin (BTC), Ethereum (ETH), Arbitrum (ARB), Uniswap (UNI), Avalanche (AVAX), and popular stablecoins.

-

Dopex (DPX)

DeFi options are a promising niche, but risks and limited resources remain the major challenges. Fortunately, we’ve seen some early efforts on Arbitrum, with Dopex (DPX) at the forefront.

Dopex is a decentralized options exchange that provides a platform for users to trade using option contracts. These contracts offer protection for option writers against losses and allow option buyers to maximize liquidity.

The key products offered by this exchange are Single Staking Option Vaults (SSOVs), Option Liquidity Pools, and Atlantic Options.

Built on Arbitrum, Dopex stands out among decentralized platforms due to its unique features that prioritize user experience. The protocol employs a dual token model, with governance, incentive token DPX and rebate token rDPX. DPX holders can also participate in decision-making processes.

-

Treasure (MAGIC)

It’s hard to beat the fact that the gaming industry is in transition. Blockchain and a number of inventions like play-to-earn mechanics and non-fungible tokens (NFTs) have unlocked new types of gaming experiences that were impossible before. Among the prominent projects, Treasure leads the way in Web3 gaming innovation.

Treasure aims to become home to numerous game publishers, builders, and players. It builds, publishes, and releases games in a Web3 ecosystem powered by MAGIC, the ecosystem’s currency.

Interested participants can play some of Treasure’s games by logging in and connecting with their MetaMask wallets. Most games are in development and users are welcome to leave feedback.

-

Radiant Capital (RDNT)

Radiant Capital (RDNT) is a cross-chain lending protocol that facilitates lending and borrowing supported assets across multiple chains. The project aims to become the first money market that efficiently implements the omnichain model.

Cross-chain interoperability is the major highlight of the project. Powered by LayerZero, Radiant enables users to access liquidity from various ecosystems without the hassle of bridging assets and the need for intermediaries.

Apart from cross-chain lending and borrowing, the project also features a native omnichain bridge and borrow & bridge function via Stargate.

RDNT is Radiant’s native utility token. Users can lock RDNT to grant voting power in Radiant DAO and join on-chain governance. The token is also used as a reward for liquidity providers and lenders.

-

Jones DAO (JONES)

Jones DAO (JONES) is a decentralized yield, strategy, and liquidity protocol for options. It simplifies the process for individuals who may not have the expertise to construct and manage complex options trades themselves.

Jones DAO generates yield by introducing yield-generating vaults. User funds will be deposited in vaults and deployed into various option strategies. Users deposit funds into designated vaults and gain exposure to various options strategies while receiving jAssets, options-backed assets that represent their share of the vault’s assets.

Jones DAO’s vaults contribute to the overall liquidity and capital efficiency of DeFi options markets, such as Dopex. This approach also reduces the cost of options trading.

Two advanced Jones vaults are jUSDC Vault and jGLP Vault. In April 2023, the protocol introduced jAura auto-compounding vault strategy that enables users to earn yield on their Aura tokens.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Solana

Solana  USDC

USDC  XRP

XRP  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  TRON

TRON